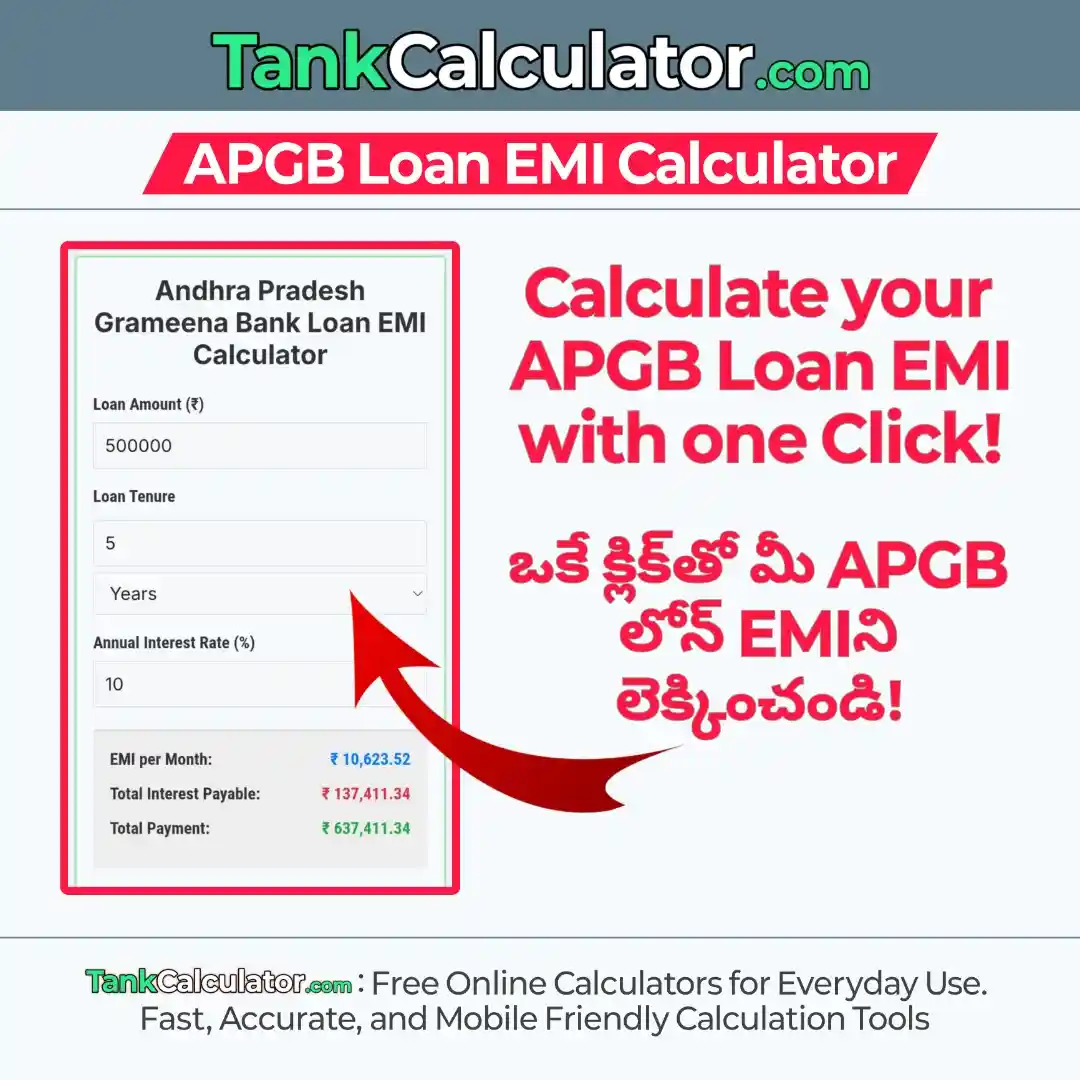

To calculate your APGB Loan EMI, enter the following details given below:

Andhra Pradesh Grameena Bank Loan EMI Calculator

Outstanding Principal Over Time

Payment Breakdown

Amortization Schedule

| Year | Principal Paid (₹) | Interest Paid (₹) | Remaining Balance (₹) |

|---|

Quick Navigation:

What is APGB

APGVB (Andhra Pradesh Grameena Vikas Bank), or Andhra Pradesh Grameena Bank, is a Regional Rural Bank (RRB) predominantly operative in the state of Andhra Pradesh and having a large presence in rural and semi urban areas of the said state. The primary aim of establishing the Bank was to provide banking and financial services to the rural masses, in particular to farmers, small entrepreneurs, agricultural laborers, and self help groups (SHGs). The most important aspect of the bank is to ensure that financial inclusion is promoted and that affordable banking services reach even the most remote villages in the state.

Bank Details

- Full Name: Andhra Pradesh Grameena Vikas Bank (APGVB)

- Type: Regional Rural Bank (RRB)

- Sponsored by: State Bank of India (SBI)

- Established on: 31 March 2006

- Head Office: Warangal, Telangana

- Operating Area: Andhra Pradesh and Telangana (after the state bifurcation in 2014)

What is an EMI

EMI means monthly commitment. It’s a fixed monthly payment to an external lender up until the last penny has been cleared on your loan.

Each EMI consists of two parts the principal outstanding loan balance amount and cost of borrowing interest. over time, your interest portion decreases each month, while your principal portion increases, making repayment of your loan comfortable and organized step by step.

How to Calculate Loan EMI Manually

Formula:

- EMI = [P × R × (1 + R)^N] / [(1 + R)^N – 1]

Where,

- P = Loan amount (principal)

- R = Monthly interest rate (Annual rate ÷ 12 ÷ 100)

- N = Loan tenure in months

Example:

- Loan amount (P) = ₹1,50,000

- Annual interest rate = 8%

- Tenure = 12 months

Step 1: Convert rate to monthly rate

- R = 8 ÷ 12 ÷ 100 = 0.006667

Step 2: Apply EMI formula

- EMI = [P × R × (1 + R)^N] ÷ [(1 + R)^N – 1]

- EMI = [150000 × 0.006667 × (1 + 0.006667)^12] ÷ [(1 + 0.006667)^12 – 1]

Step 3: Simplify

- EMI = (1 + 0.006667)^12 = 1.0830

- EMI = (150000 × 0.006667 × 1.0830) ÷ (1.0830 – 1)

- EMI = (1082.9) ÷ (0.0830)

- EMI = ₹13,046.99

Final EMI = ₹13,047 /per month

Total payment: 13,047 × 12 = ₹1,56,564

Total interest: 1,56,564 – 1,50,000 = ₹6,564

How to Use TankCalculator’s Andhra Pradesh Grameena Bank Loan EMI Calculator

- 1. Enter Your Loan Amount

- The amount you are planning to borrow for exp ₹1,50,000 or more.

- 2. Set Your Loan Duration

- In years or months you will take to repay.

- 3. Add Your Interest Rate

- Enter the annual interest rate offered by APGB for exp, 8%.

- 4. And Just Click On Calculate Button

- That’s it! Instantly view your monthly EMI, with a beautiful, interactive chart showing your total payable interest and overall repayment amount.

TankCalculator’s APGB Loan EMI Calculator: Features and Benefits

APGB Loan EMI Calculator is a smart tool that helps you to instantly estimate your monthly EMI, total interest payable, and overall repayment amount with complete clarity. It makes financial planning fast, simple, visual, and accurate.

Features of APGB Loan EMI Calculator

Easy to use and navigate: Enter your loan amount, interest rate, and loan period in given columns and get instant results in just one click.

Interactive Charts and Payment Tables: See your repayment journey through a detailed table, as well as dynamic line and donut charts for more clarity.

Customizable Inputs: You can also adjust the period to years or months for highly accurate calculations.

Export and Print Options: The calculator allows you to easily download results to Excel (CSV) or print your EMI report for record keeping and analysis for your future savings.

Responsive and Mobile Friendly: The calculator is optimized for desktop, tablet, and mobile ensuring a seamless experience across all devices.

Benefits of APGB Loan EMI Calculator

This APGB Loan EMI Calculator helps you to make informed decisions.

Time saver: Manual calculation? nay! get instant results in seconds with complete accuracy!

For beginner understandability: Visual charts and tables clearly explain how timely repayment helps you.

Compare different EMI options: Experiment with different rates, period to get more knowledge.

Peace of mind and transparency: Know exactly how much you have to pay per month, no hidden steps, no confusion, and complete clarity that empowers your financial decisions.

Frequently Asked Questions (FAQ)

Can I pay my Andhra Pradesh Grameena Bank loan EMI online?

Yes, Andhra Pradesh Grameena Bank (APGB) loan EMI could be paid via online routes such as Internet banking, mobile banking app, or UPI above and any best bank-supported payment platform such as BBPS and Bajaj Finserv could be used.

What types of loan does Andhra Pradesh Grameena Bank offer?

Andhra Pradesh Grameena Bank provides an array of loan types to cater to different financial requirements. These are personal loans, house loans under the Pragathi Swagraha scheme, vehicle and auto loans under the Pragathi SRTO program, agriculture loans for farmers and allied sectors, and MSME or small business loans for entrepreneurs and self employed people.

How can I contact Andhra Pradesh Grameena Bank for loan or EMI-related questions?

Do you need help for any questions about loans or EMI? Just call Andhra Pradesh Grameena Bank’s toll-free numbers: 1800 425 5115, 1800 121 0354, 1800 533 7444, 1800 833 1004, and 1800 123 6230. You can also email them at customercare@apgb.bank or complaints@apgb.bank.

Can the interest rate on my Andhra Pradesh Grameena Bank loan change during the term?

The application of floating interest rates on Andhra Pradesh Grameena Bank loans, like every other floating interest loans, also implies that such an interest rate on the loan may vary from time to time during the loan tenure, provided the measures have been stipulated in the Credit Policy under which loan amounts of different borrowers are computed. Now APGB interest rates differ normally depending upon their own risk classification, borrower profile, or even market conditions based on which they operate.

Can I prepay my Andhra Pradesh Grameena Bank loan before the end of the term?

Yes, you can prepay your Andhra Pradesh Grameena Bank loan before the end of the term. In cases, especially for home loans, APGB allows prepayment or forfeiture without any penalties or additional charges.

What is the Andhra Pradesh Grameena Bank loan EMI interest rate?

Andhra Pradesh Grameena Bank loan EMI interest rates vary depending on the loan category and borrower profile. Home loans for low risk typically cost around 8.95% per annum, vehicle loans around 9.15%, personal loans around 10.50%, and agricultural loans can go up to 12% per annum. Rate depends on factors such as your credit score(CIBIL), risk category, repayment capacity, and the specific loan plan chosen.