To calculate your Fixed Deposit, enter the following details given below:

FD Calculator

FD Maturity Details

Growth Table

| Year | Opening Balance | Interest Earned | Closing Balance | Total Interest So Far |

|---|

Table of Contents

What is an FD (Fixed Deposit)?

Among the many financial products available, the Fixed Deposit (FD) remains a favorite for its reliability and predictability. When you invest in an FD fund you deposit a fixed sum with a bank for a specific period and in return the bank will pays you interest at a predetermined rate.

Unlike market linked investments like stocks or mutual funds, FD is a guarantee returns from day one. That means no worrying or tension about volatility or market swings. It’s a safe option for anyone who prefers stability and wants a steady income from their saving amount. Whether you are planning a down payment for your house and your child’s education or simply building an emergency fund for future, These FDs provide a strong financial foundation.

Investing in a Fixed Deposit (FD) is one of the most secure ways to grow your savings. But calculating potential returns can be feel confusing. This is where an FD calculator make things simple. As a financial expert, I will walk you through how this tool works and why it is so valuable for planning your financial future.

What is an FD Calculator?

A Fixed Deposit (FD) calculator is an online tool that helps you calculate the maturity amount and interest earned on your FD. It works using compound interest formulas but without the hassle of manual math. You just enter your details and the calculator instantly shows you how your money will grow over time.

How can an FD Calculator Help You?

When you are planning your finances, knowing exactly how your money will grow is crucial. An FD calculator online provides this clarity in seconds helping you plan more effectively and avoid guesswork. Whether you’re comparing multiple banks or trying to decide the right tenure for your savings this tool makes decision making much easier.

- Financial Planning: It gives you accurate projections, helping in set realistic goals for your home purchases, retirement or educations.

- Scheme Comparison: Instant compare interest rates, tenures and compounding frequencies offered by different banks.

- Smarter Decisions: By knowing the maturity amount in advance you can confidently decide how much you have to invest and for how long.

Fixed Deposit Calculator: Features and Benefits

Using a fixed deposit (FD) calculator is not just about getting quick results it’s more than that. In reality, it helps you to plan and manage your savings more smartly. Our FD calculator is simple, fast and free, providing real time responses so you can see how your investment grows instantly. With Clean Interface it is user friendly and easy to use, making it perfect for beginners and most of experienced investors.

Features of our FD Calculator

- Custom Inputs: Enter your principal, interest rate and duration (years, months or days).

- Compounding Options: Choose annual, half yearly, quarterly or monthly compounding.

- Detailed Results: Instantly see your principal, total interest earned and maturity amount.

- Visual Charts: Track growth with clear line graphs and doughnut charts.

- Yearly Tables: Get a simple year-by-year breakdown of balances and interest.

- Export & Print: Save your results as CSV files or print for easy and understandable reference.

Benefits of our FD Calculator

- Accuracy: No manual calculation errors.

- Time Saving: Get instant results for multiple scenarios.

- Clarity: Charts and tables make returns easy to understand.

- Empowerment: Experiment with different amounts, rates and tenures to find the best strategy.

- Simple & Free: Completely free to use, with an intuitive interface.

- Real Time Response: See results immediately as you enter your inputs.

- User Friendly: Designed for everyone, even if you have no financial knowledge you can use it like professionals.

How to Use an FD Calculator?

For beginners, using an FD calculator is extremely simple and requires no financial knowledge. With just a few clicks, you can find out how much your savings will be worth at the end of your chosen tenure. This is particularly helpful when you are comparing best FD rates across banks, as the tool it automatically adjusts calculations based on the rate you input.

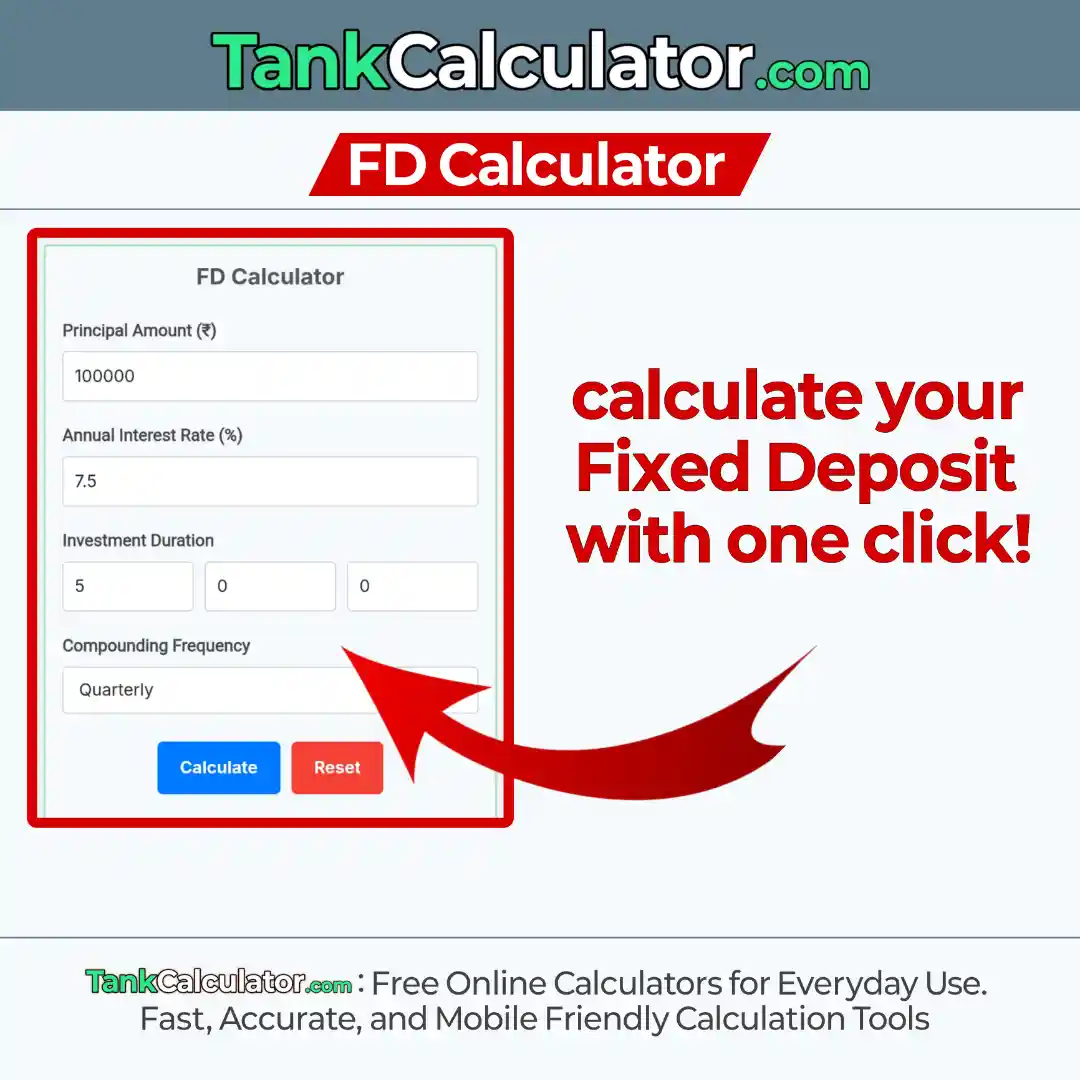

Using it is quick and straightforward:

- Enter your principal amount.

- Input the interest rate.

- Choose the tenure (years, months, or days).

- Select the compounding frequency.

- View your results instantly with maturity amount, interest earned, and breakdowns.

Example of FD Calculation

Let’s say you invest ₹1,00,000 in a Fixed Deposit for 5 years at an annual interest rate of 6.5%, compounded quarterly.

- Principal: ₹1,00,000

- Tenure: 5 years

- Rate: 6.5% (quarterly compounding)

- Maturity Value: ₹1,38,949

- Total Interest Earned: ₹38,949

Fixed Deposit Breakdown Table (6.6% Annual Interest, Compounded Monthly):

| Principal (₹) | Period | Interest Rate | Maturity Value (₹) | Interest Earned (₹) |

| 50,000 | 1 Month | 6.6% | 50,275 | 275 |

| 50,000 | 2 Months | 6.6% | 50,552 | 552 |

| 50,000 | 3 Months | 6.6% | 50,830 | 830 |

| 50,000 | 1 Year | 6.6% | 53,402 | 3,402 |

| 50,000 | 5 Years | 6.6% | 69,486 | 19,486 |

| 50,000 | 10 Years | 6.6% | 96,476 | 46,476 |

| 1,00,000 | 1 Month | 6.6% | 1,00,550 | 550 |

| 1,00,000 | 2 Months | 6.6% | 1,01,105 | 1,105 |

| 1,00,000 | 3 Months | 6.6% | 1,01,660 | 1,660 |

| 1,00,000 | 1 Year | 6.6% | 1,06,804 | 6,804 |

| 1,00,000 | 5 Years | 6.6% | 1,38,971 | 38,971 |

| 1,00,000 | 10 Years | 6.6% | 1,92,952 | 92,952 |

| 5,00,000 | 1 Month | 6.6% | 5,02,748 | 2,748 |

| 5,00,000 | 2 Months | 6.6% | 5,05,523 | 5,523 |

| 5,00,000 | 3 Months | 6.6% | 5,08,301 | 8,301 |

| 5,00,000 | 1 Year | 6.6% | 5,34,018 | 34,018 |

| 5,00,000 | 5 Years | 6.6% | 6,94,857 | 1,94,857 |

| 5,00,000 | 10 Years | 6.6% | 9,64,760 | 4,64,760 |

| 10,00,000 | 1 Month | 6.6% | 10,05,496 | 5,496 |

| 10,00,000 | 2 Months | 6.6% | 10,11,046 | 11,046 |

| 10,00,000 | 3 Months | 6.6% | 10,16,601 | 16,601 |

| 10,00,000 | 1 Year | 6.6% | 10,68,037 | 68,037 |

| 10,00,000 | 5 Years | 6.6% | 13,89,713 | 3,89,713 |

| 10,00,000 | 10 Years | 6.6% | 19,29,520 | 9,29,520 |

How to Calculate Fixed Deposit Interest Rates Manually

Whenever you will go for investing in a Fixed Deposit (FD) you typically get surrounded by two types of interest calculations: Simple Interest (SI) and Compound Interest (CI). Understanding these helps you estimate your calculate profits correctly. Many banks and fintech platforms provide online FD calculators to simplify this overall process.

Simple Interest FD:

In a Simple Interest FD, the interest is calculated only on the principal amount for the entire tenure.

Formula for Simple Interest:

- SI = Principal × Rate × Time / 100

Example:

- If you invest ₹1,00,000 at an interest rate of 6% per year for 3 years, the simple interest earned would be

- SI = 1,00,000 × 6 × 3 / 100 = ₹18,000

- Maturity Amount = Principal + Interest = ₹1,18,000

Compound Interest FD:

In a Compound Interest FD, interest is calculated on the principal + accumulated interest and it can be compounded monthly, quarterly, half-yearly or annually.

Formula for Compound Interest:

- Maturity Amount = Principal × (1 + Rate of Interest / 100 / n)^(n × t)

Where:

- Principal = initial deposit amount

- Rate of Interest = annual interest rate

- n = number of times interest is compounded per year

- t = tenure in years

Example:

- Investing ₹1,00,000 at 6% per year, compounded quarterly, for 3 years

- Maturity Amount = 1,00,000 × (1 + 0.06 / 4)^(4 × 3) ≈ ₹1,19,100

Why to Use an FD Calculator?

An FD calculator is not just for convenience it’s an essential financial tool for anyone who are serious about maximizing their savings. Instead of relying on rough estimates or assumptions, you will get clear and realtime results. This helps you in better planning, FD schemes comparision, and Confident investment decisions.

People use FD calculators because they:

- Provide instant and accurate results without manual effort.

- Show investment growth visually through charts and tables.

- Offer a yearly breakdown for full transparency.

- Allow experimentation with different amounts, rates, and tenures.

- Make it easy to save or print reports for personal records.

Advantages of Using an FD Calculator

An FD calculator is not just a simple tool, it is a financial companion that helps you to make smarter decisions using less effort. By offering quick calculations and detailed insights, it ensures you always get to the most out of your savings. Here are some clear advantages:

- Convenience: No need for complex math or lengthy formulas.

- Comparison Power: You can easily test different banks and their FD schemes.

- Flexibility: You can change inputs anytime to find the ideal investment strategy.

- Transparency: it shows a clear breakdown of how your money grows over time.

- Confidence: Helps you invest with clarity, knowing the exact maturity value.

Fixed Deposit (FD) Interest Rates in India

Fixed Deposit (FD) interest rates in India differ from one bank to another, which makes it important for investors to compare options before committing their investment. FDs are considered one of the safest ways to invest, as they provide guaranteed returns and protect savings from market risks.

In 2025, most public sector banks such as SBI, Bank of Baroda and Canara Bank are offering rates in the range of 6% to 7.5%. Private banks like HDFC and ICICI usually provide similar or slightly higher rates. For those who wants to maximize their returns, small finance banks and NBFCs.

Bajaj Finance and AU Small Finance Bank are offering higher rates of Up to 8%-9%, especially on longer tenures and for senior citizens. Staying updated with the latest FD rates in India not only helps you to pick the most suitable scheme but also enables you to earn more and align your investments with your financial goals and needs.

Latest FD Interest Rates 2025: Bank Comparison (Regular Depositors)

| Bank | General Public Rate (p.a.) | Senior Citizen Rate (p.a.) | Typical Tenure / Notes |

| HDFC Bank | Up to 6.60 % | Up to 7.10 % | 18–21 months |

| ICICI Bank | Up to 6.60 % | Up to 7.10 % | 2 years & above |

| Kotak Mahindra Bank | Up to 6.60 % | Up to 7.10 % | 391 days–23 months |

| Federal Bank | Up to 6.70 % | Up to 7.20 % | 999 days |

| SBI | Up to 6.45 % | Up to 6.95 % | 2 – 3 years |

| PNB | Up to 6.60 % | Up to 7.10 % | 390 days (effective Sept 1) |

| Union Bank of India | Up to 6.60 % | Up to 7.10 % | 3 years (effective Aug 20) |

| Axis Bank | Up to 6.60 % | Up to 7.35 % | Varies by tenure |

| Bandhan Bank | Up to 7.40 % | Up to 7.90 % | Up to 3 years |

| Central Bank of India | Up to 6.60 % | Up to 7.10 % | 1–3 years |

| IDBI Bank | Up to 6.75 % | Up to 7.05 % | General range |

| IDFC FIRST Bank | Up to 7.00 % | Up to 7.25 % | Varies by term |

| IndusInd Bank | Up to 7.00 % | Up to 7.50 % | Popular rate tier |

| YES Bank | Up to 7.00 % | Up to 7.75 % | 3–5 years |

| RBL Bank | Up to 7.20 % | Up to 7.90 % | Variable term |

| Karnataka Bank | Up to 6.55 % | Up to 7.15 % | Varies |

| Tamilnad Mercantile Bank | Up to 7.05 % | Up to 7.55 % | Extended range |

| Indian Bank | Up to 7.15 % (e.g., 444 days) | Up to 7.65 % (444 days) | Special FD schemes |

| Bank of Baroda (BoB) | Up to 6.60 % | Up to 7.10 % | Includes 444-day “Square Drive” FD: 6.6 % / 7.1 % |

| Canara Bank | Up to 7.25 % | Up to 7.75 % | 444-day FD: 7.25 % / 7.75 %; other tenures up to 7.20 % / 7.70 % |

Note : Rates are indicative and subject to change. You should always consult the respective bank and confirm the interest rates before making any financial decision.

Investment Alternatives to Fixed Deposits

While Fixed Deposits (FDs) are safer and reliable option but there are several alternatives that are offering higher returns and greater flexibility compare to FDs:

- Mutual Funds: Pool money from multiple investors to invest in stocks, bonds or a mix of assets. Possibly gives higher returns than FDs but they are market linked and it carry some risk.

- Recurring Deposits (RDs): It Allow you to save a fixed amount every month and earn interest similar to FDs. Ideal for disciplined investors, regular savings.

- Stocks and Exchange Traded Funds (ETFs): Can provide significant capital appreciation over the long term But Requires deep research and risk management, suitable for investors with higher risk tolerance.

- Government backed Schemes: Options like Public Provident Fund (PPF) or National Savings Certificate (NSC) offer safer returns with added tax benefits too.

- Diversified Approach: Combining FDs with these alternatives helps you to create a balanced portfolio, optimizing returns while managing risk according to your financial goals, tenure and comfort level with risks.

Frequently Asked Questions (FAQ)

1. Which bank FD interest rate is highest?

As of 2025, small finance banks like AU, Jana, or Equitas often offer the highest sometimes 8% to 9%. Big banks like SBI, HDFC, ICICI hover around 6% to 7.5%.

2. Is FD better than a savings account?

Yes. FDs usually give 6% to 8%, while savings accounts offer 2% to 4%. But savings accounts let you withdraw anytime, while FDs lock your money.

3. Is there a penalty for withdrawing from a fixed deposit?

Yes. Premature withdrawals usually carry a 0.5% to 2% penalty. Some tax-saver FDs don’t allow withdrawal at all.

4. How much FD is tax free?

Interest on regular FDs is taxable. But a 5 year tax saver FD qualifies for deduction under Section 80C (up to ₹1.5 lakh).

5. Which is better, FD or mutual fund?

If you want safety and guaranteed returns, FD. If you want higher growth and can handle risk, mutual funds.