To calculate your APGB Recurring Deposit, enter the following details given below:

Andhra Pradesh Grameena Bank RD Calculator

Investment Growth Over Time

Final Breakdown

Year-by-Year Growth

| Year | Total Invested (₹) | Interest Earned (₹) | Matured Value (₹) |

|---|

Quick Navigation:

What is RD

An Recurring Deposit (RD) is a savings plan in which you deposit fixed amounts every month for a set period of time. Your regular monthly contribution would thus grow with earned compound interest, and you will be able to build a huge savings corpus effortlessly.

With fixed deposits (FDs), a lump sum amount is required as an investment, whereas RDs work best for those individuals who want to save a little each month with ease and without burning a hole in their pockets. Hence this makes Recurring Deposits a good choice for salaried individuals, students, and even those small investors who want to cultivate a habit of disciplined saving and earn safe and guaranteed returns on investments.

What is APGB

APGVB (Andhra Pradesh Grameena Vikas Bank), or Andhra Pradesh Grameena Bank, is a Regional Rural Bank (RRB) predominantly operative in the state of Andhra Pradesh and having a large presence in rural and semi urban areas of the said state. The primary aim of establishing the Bank was to provide banking and financial services to the rural masses, in particular to farmers, small entrepreneurs, agricultural laborers, and self help groups (SHGs). The most important aspect of the bank is to ensure that financial inclusion is promoted and that affordable banking services reach even the most remote villages in the state.

Bank Details

- Full Name: Andhra Pradesh Grameena Vikas Bank (APGVB)

- Type: Regional Rural Bank (RRB)

- Sponsored by: State Bank of India (SBI)

- Established on: 31 March 2006

- Head Office: Warangal, Telangana

- Operating Area: Andhra Pradesh and Telangana (after the state bifurcation in 2014)

Interest Rate of RD in APGB?

| Tenure (Period) | Interest Rate (p.a.) | Senior Citizens (p.a.) |

| 7 days to 45 days | 4.00% | 4.50% |

| 46 days to 90 days | 4.50% | 5.00% |

| 91 days to 179 days | 5.00% | 5.50% |

| 180 days to 364 days | 5.75% | 6.25% |

| 1 year to less than 2 years | 7.35% | 7.85% |

| 2 years to less than 3 years | 7.00% | 7.50% |

| 3 years to less than 5 years | 6.50% | 7.00% |

| 5 years and above | 6.50% | 7.00% |

Disclaimer: Rates vary by tenure, amount and category of depositor (senior citizens get extra). Always check the latest rates by visiting banks before investing.

How to Calculate RD Manually

Formula:

- Maturity Amount (M) = (Monthly Deposit × Number of Months) + Interest

Where,

- Interest = Monthly Deposit × [Number of Months × (Number of Months + 1) ÷ 2] × (Rate of Interest ÷ 12 ÷ 100)

Example:

- Monthly Deposit = ₹1,000

- Tenure = 2 years (24 months)

- Annual Interest Rate = 7%

Step 1: Calculate the Interest

- Interest = 1000 × [24 × (24 + 1) ÷ 2] × (7 ÷ 12 ÷ 100)

- Interest = 1000 × (24 × 25 ÷ 2) × 0.005833

- Interest = 1000 × 300 × 0.005833

- Interest = ₹1,750 (approximately)

Step 2: Add the Principal Amount

- Principal = 1000 × 24 = ₹24,000

Step 3: Calculate Maturity Amount

- Maturity Amount = 24,000 + 1,750 = ₹25,750 (approximately)

Your RD maturity amount will be around ₹25,750 after 2 years at 7% interest.

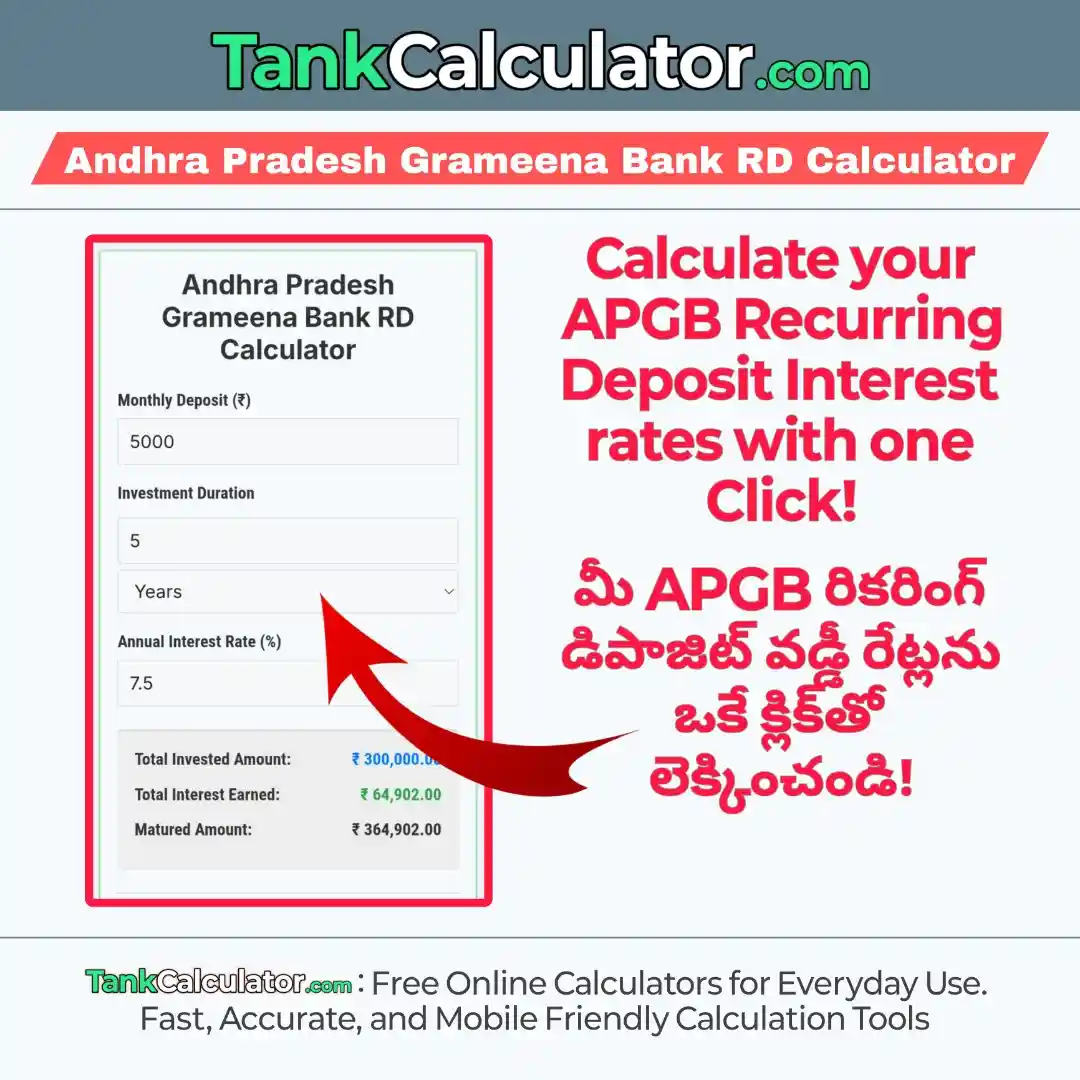

How to Use TankCalculator’s Andhra Pradesh Grameena Bank RD Calculator

- 1. Enter Your Principal Amount

- the amount you plan to invest for exp ₹1,00,000 or more.

- 2. Set Your Investment Duration

- in years, months, and even days for extra precision.

- 3. Add Your Interest Rate

- Enter the annual interest rate offered by your bank for exp, 7%.

- 4. And Just Click On Calculate Button

- That’s it! Instantly, you’ll see a beautiful visualization of your maturity amount, total interest earned, and growth over time in an interactive chart.

TankCalculator’s APGB RD Calculator: Features and Benefits

RD Calculator also known as Recurring Deposit Interest Calculator is a smart tool that helps you instantly estimate the maturity amount, total interest earned, and the growth of your investment over time. It makes financial planning fast, simple, visual, and accurate.

Features of RD Calculator

Easy to use and navigate: Enter your principal amount, interest rate, terms in given columns and get instant results in just one click.

Interactive Charts and Growth Tables: See your investment progress through a detailed year by year growth table, as well as dynamic line and donut charts for more clarity.

Customizable Inputs: You can also Adjust the term to years, months, and days for highly accurate calculations.

Export and Print Options: The calculator allows you to Easily download results to Excel (CSV) or print your RD report for record keeping and analysis for your future planning.

Responsive and Mobile Friendly: The calculator is Optimized for desktop, tablet, and mobile ensuring a seamless experience across all devices.

Benefits of RD Calculator

This RD Calculator Helps you to make informed decisions, Investment planning is done best when you know how much your money would grow over time.

Time saver: Manual calculation? Nay! Get instant results in seconds with complete accuracy!

For beginner understandability: Visual charts and tables clearly explain how interest benefits you.

Compare different RD options: Experiment with different rates, tenures to get the best returns.

Peace of mind and transparency: Know clearly how much you’ll make as returns no hidden steps, no confusion, and utter clarity.

About TankCalculator’s Andhra Pradesh Grameena Bank RD Calculator

For residents of Andhra Pradesh, managing your recurring deposits has never been easier with this Andhra Pradesh Grameena Bank RD Calculator.

This APGB RD calculator helps you accurately estimate the maturity amount of your recurring deposit on the monthly installment amount, interest rate, and tenure. It’s a practical way to plan your savings, track your investment growth, and achieve your financial goals with ease.

Suitable for both salaried individual, student, or small investor, this calculator provides a quick and reliable way to understand your RD income.

Frequently Asked Questions (FAQ)

What is the minimum balance required at APGVB Bank?

The minimum balance required to start a recurring deposit is usually ₹100 or may be more, depending on the branch and bank scheme type.

Can I prematurely withdraw from APGVB RD?

Yes, premature withdrawal is allowed. However, an interest penalty of up to 1% may apply on the applicable rate.

What is the minimum monthly deposit for an APGVB RD?

The (EMI) usually starts from ₹100 and can increase according to your preference or the bank’s rules.

How to open an APGVB RD account?

You can open your RD account by visiting nearest APGVB branch, filling out the RD application form with submitting KYC documents, and making the first deposit. You can also set up auto debit from your savings account for monthly payments.